The Money Making Machine Behind the Polygon Spam Attacks

At a gas price of 1 gwei or 0.000000001 MATIC/gas, and a 20 million gas limit per block, flooding a complete Polygon block costs approximately 0.02 MATIC, equivalent to $1,000 for an entire day.

While flooding a complete block is inexpensive, the question remains: What motivates such actions?

This piece elucidates the mechanics of spam transactions and the associated profits. Our investigation proposes that raising gas fees to 30 gwei might prove highly effective in addressing this issue.

The Arbitrage Bot Behind these Spam Attacks

Identifying the Sender

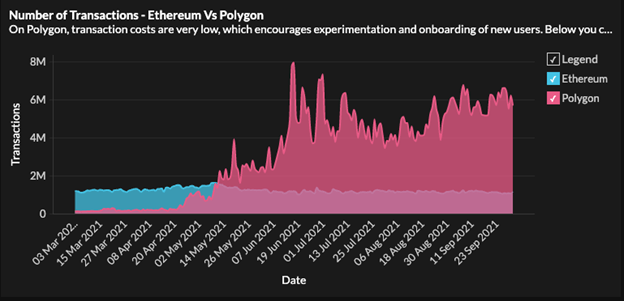

The top 10 DApps record 3 million weekly transactions, roughly 420k daily. Despite this, the entire network processes 4M-6M daily transactions, leaving over 90% unaccounted for. Where do the remaining transactions originate?

Source: Polygon dashboard

Identifying the Recipient

Source: Transaction

In the described transaction, the contract sent 0.153 MATIC valued at 0.23$ and received 4.33 MATIC worth 6.5$.

An arbitrage bot takes advantage of differing exchange rates across platforms for profit. For example, if Uniswap quotes 3700$ / ETH and Sushi offers 3600$ / ETH, the bot can simultaneously buy on Sushi and sell on Uniswap, exploiting the 100$ difference.

The comprehensive scenario is evident: spam attack transactions act as triggers for arbitrage bots to conduct transactions on decentralized exchanges (DEXes), leveraging market discrepancies to generate profits.

When graphing the total transactions initiated by these bot contracts, it becomes apparent that they execute approximately 2,000 – 4,000 transactions daily, a frequency that is not uncommon in such activities.

Source: Polygon dashboard

By visualizing the total transactions initiated by these bot contracts, it’s evident they conduct approximately 2,000 – 4,000 transactions daily, a frequency typical for such activities.

The likely theory proposes the owner spams the contract to prevent others from front-running the actual trade. Rather than relying on priority fees for the first block position, they flood it with noise. The question arises: is purchasing an entire block genuinely more cost-effective than paying exorbitant fees for priority?

How much is this spammer making?

Increasing Transaction Fees